Cardlytics – The Largest Advertising Platform You’ve Never Heard Of

Cardlytics is an emerging monopoly with privileged access to half of the purchase transactions in the US which it uses to deliver targeted card-linked offers to a captive user base of nearly 180M MAUs

Value Proposition:

Cardlytics is the third largest advertising platform in the US based on MAUs. Over the past decade-plus, co-founders Lynne Laube and Scott Grimes, both former Capital One executives, have formed partnerships with over 2,000 bank partners, including 7 of the 10 largest banks in the US, resulting in 179.9M MAUs and insight into half of the purchase transactions in the US or $3.9T in annual spend. The banks share anonymized transaction data with Cardlytics which is then used to target cash back offers presented through an offer wall within banking applications. Cardlytics currently works with over 600 advertisers across retail, restaurant, subscription services, travel and entertainment, grocery, e-commerce, and luxury brands including Starbucks, Disney, Walmart, DoorDash, and Dunkin’ Donuts.

Although Cardlytics does not own the bank channel, it benefits all stakeholders, thus creating lock-in.

Advertisers

Advertisers value advertising channels on the basis of three factors: scale, return on ad spend (ROAS), and measurability. Cardlytics is able to provide 5x ROAS and as high as 30x ROAS, verified through control groups, across unmatched scale. It generates such high ROAS because it targets offers based on users’ historical purchase data, which is evidently a great predictor of where they will continue to shop. Offers can be targeted specifically to capture wallet share from competitors for existing customers or win new, loyal customers by incentivizing them to try new products. Bank channels are also a brand-safe environment and Cardlytics can conduct randomized control trials to find actual incrementality and give certainty in results, again due to the transaction data.

Banks

Banks primarily value user engagement, as they seek to differentiate their banking experiences from competitors and drive increased spend. To a lesser extent, they value the revenue share that Cardlytics provides, amounting to 35% of billings. Cardlytics succeeded in getting bank transaction data where dozens of other start-ups failed because the bank data never has to leave the banks’ firewalls. Advertisers give all their targeting parameters to Cardlytics and Cardlytics’s algorithm goes into the bank data to find the relevant users without actually seeing any personal identifiable information (PII).

Bank Customers

Bank customers value discounts, which we know from their usage of direct-to-consumer cashback apps like Rakuten and Ibotta. Cardlytics is able to offer greater discounts as a function of its superior targeting and attribution, which can range from 5% off coupons to free meals and $50 off coupons. Cardlytics has provided $650M in rewards since its inception in 2008. Cardlytics is unique in that there is a symbiotic relationship between advertisers and consumers. Contrast this with any other ad platform for example, where more advertisers create a worse user experience and in some cases like Facebook, cause privacy concerns through very granular targeting.

Competitive Advantages:

The value that Cardlytics provides for all stakeholders enables a self-reinforcing network effect, whereby more banks mean more consumers, which attracts more advertisers, leading to more engagement which attracts even more banks. Since Cardlytics has largely already reached scale (projecting mid-single-digit MAU growth) and is focused on scaling its ad platform, the primary benefit of more advertisers is creating greater lock-in with the banks, as switching costs should become higher over time due to the difficulty of replicating the advertiser network while losing the revenue share.

These network effects result in a natural monopoly because banks have limited digital real estate and thus face a high opportunity cost (fewer and worse offers) if they were to leverage a subscale competitor. Industry experts have also mentioned that having multiple providers on a single offer wall would lead to a worse and more confusing experience for customers. Security is also the utmost priority for the banks, and they are unlikely to trust a smaller competitor that doesn’t have the decade-long track record that Cardlytics has. Since banks are competing with each other, they will also find it difficult to do this themselves because no single bank can match Cardlytics’s scale as the neutral aggregator.

The largest bank, JP Morgan Chase, had just 11% market share as of 2018, followed by Wells Fargo and Bank of America at 9% each. Chase serves 66M American households and attempted to build its own solution for almost 6 years prior to signing with Cardlytics in 2018. Large advertisers will not bother with smaller advertising platforms even if they have great ROAS because they do not move the needle for them. Advertisers also need to invest time learning the platform, getting comfortable with attribution metrics, and running campaigns, so this leads to consolidation on the supplier side.

Despite the strength of the value proposition outlined thus far, their historical financials don’t come close to reflecting the potential of the platform. After over a decade in business, Cardlytics had just $267M in revenue in 2021 and -$12M in EBITDA and grew ~31% YoY organically. However, sales actually declined 11% YoY in 2020 so they only grew 17% organically from 2019. They are projected to grow 19% YoY in 2022, taking the midpoint of their H2 guide. They continue to be unprofitable, though they are projecting to be EBITDA positive in 2023 and cash flow breakeven by Q3’23. Management has reiterated that they believe this business can grow at a 30% CAGR for a long time. However, they’ve only grown at that rate for three out of the past six years. These were their YoY growth rates for FY’16, 17, 18, 19, 20, and 21 respectively: 44%, 15%, 15%, 40%, -11%, and 31%.

Catalysts:

Most investors would likely stop there. However, upon closer examination, there are good reasons why they’ve failed to grow faster in the past. Let’s analyze them each and how all of them are being addressed, setting them up to potentially maintain a higher growth rate in the future:

1. Lack of self-service

Problem:

Cardlytics has traditionally sold directly to advertisers, which has limited its reach to only the largest, national advertisers. Compare this to Facebook, where 76% of its revenue comes from SMBs. Because each advertiser account requires a dedicated person at Cardlytics to build their campaign for them, this was also a more costly way to scale.

Solution:

Cardlytics rolled out its self-service platform to its employees in Q2’20 and started rolling it out to agencies in H2’21 after building an agency sales team. This is expected to continue into 2023. One common pushback is that Facebook and Google were consumer products, and thus had existing brand recognition with SMBs while Cardlytics is a white-label platform. By selling directly to agencies, Cardlytics can address this, as agencies control up to half of all digital advertising dollars. Although Cardlytics worked with agencies in the past, it never directly sold to them. Agency spend grew 50% YoY in Q2’22 and represented >10% of advertiser spend compared to >5% the previous year.

2. Advertiser skepticism over ROAS

Problem:

Advertisers traditionally used last-touch attribution models for measuring ROAS, which gives 100% credit to the last ad that consumers saw. However, this was ineffective and prone to manipulation, such as programmatic buyers purchasing a bunch of cheap inventory to increase the chances they’ll be the last impression.

Today, most sophisticated advertisers use multi-touch attribution where credit for the conversion is more evenly dispersed across multiple channels. However, Cardlytics cannot participate because they are not allowed to push individual IDs outside the banks’ firewalls. Though Google and Facebook also don’t push this data, advertisers can trust that the ROAS are real because they are so established.

Cardlytics does not release official advertiser churn numbers but in one Tegus interview, it was mentioned that a data scraper found that between 2018 and 2020, 600 advertisers had used Cardlytics but only 200 were active by 2020 and 250 prior to COVID. The primary issue was the lack of attribution. Another interview claimed the gross retention rate was in the high 60s to mid-70s with a net retention rate above 100.

Solution:

Cardlytics implemented third-party verification through Nielsen during Q4’18. Cardlytics would give their data to Nielsen and the results would be compared against Cardlytics’ own results, and the results were very similar. By 2020, renewal rates were above 80% according to a recent Tegus transcript. Some advertisers like Starbucks would do their own analysis and not require Nielsen but they also found similar ROAS as Cardlytics reported. Furthermore, Bridg should guarantee incrementality because advertisers will be able to immediately feel the uplift in certain SKUs, as opposed to running it against the entire store. Finally, IDFA has made it tougher to use multi-touch attribution models, as well as reduced the measurement capabilities of other advertising platforms, making Cardlytics relatively more attractive.

3. Poor offer presentation and bank inertia

Problem:

Cardlytics’ previous UI/UX was very dated, and this contributed to a lower level of user engagement. Out of the 171M MAUs they had in 2021, 51M activated an offer, leading to a 30% engagement rate. Each engaged user activated an average of 11.7 offers and had $5.24 ARPU. However, habitual users are an even smaller portion of total MAUs, accounting for a high single-digit percentage of their overall MAUs. Lynne has said getting users to engage for the first time is the hardest, but they know how to do so with the right content.

Solution:

Cardlytics is currently in the process of getting its bank partners on its new ad server. This promises richer imagery, push notifications, and better targeting through machine learning and more versatile offers such as timed offers, local offers, and product-level offers through Bridg, which I will cover later. Early statistics show the significant impact that even tiny changes can make to engagement. For example, early results show that users that are served hero imagery (a banner image which spans the entire length of the offer tile) are 2 to 4x more likely to visit an advertiser website. At Investor Day last year, Cardlytics announced that within the first two weeks of launch at US Bank, 1 in 2 consumers activated an offer. The new ads manager also enables much greater scalability, with Cardlytics reporting that it launched 325 campaigns over a few days compared to a maximum of 40 new campaigns a week before. As of early 2022, Cardlytics only had 5% of its MAUs connected to the new server, and they expect 50% to be connected by the end of the year, with the rest by the end of 2023.

4. Macro headwinds and advertiser departures

Problem:

COVID hit Cardlytics particularly hard, as Travel and Entertainment and Retail brands made up over half of their advertiser spend base going into lockdowns. Travel and Entertainment, comprising brands like Southwest and Hyatt, was hit the hardest and fell from over 20% of advertiser spend in Q2’19 to under 5% in Q2’20 and were still down almost 45% from 2019 as of Q4’21. Cardlytics’ largest customer, Airbnb, notably shut down all of its marketing spend across all channels and didn’t turn most of it back on. Furthermore, Cardlytics’ advertiser base was concentrated, during H1’20 and H1’21, their top five marketers accounted for 33% and 34% of revenue respectively.

Solution:

Although Cardlytics continues to experience lumpiness in revenue growth, advertiser concentration has improved significantly, with their top five advertisers making up 21% of revenue in H1’22, down from 34% in the previous year. There were over 600 advertisers on the platform in Q1 and they aim to grow that to over 1,000 by the end of the year. Engagement stats and ARPU should also be put in the context that Cardlytics only reached scale recently, after signing Wells Fargo and Chase in 2018. At the time of its IPO in early 2018, Cardlytics had 58M MAUs, half of which were from Bank of America. After signing Chase and Wells Fargo, Cardlytics reached 122.6M MAUs by the end of 2019, but engagement had not scaled proportionately, (BofA was signed in late 2010), and so ARPU dipped from $2.30 at the end of 2018 to $1.72 by the end of 2019. At the end of FY’21, MAUs were 171M and ARPU was $1.51, reflecting their difficulty in scaling the advertiser side. Remember, large advertisers like scale, and they likely did not take Cardlytics very seriously until recently, but this was also compounded by the challenging macro environment in 2020 and 2022.

5. Limited to smaller performance advertising budgets.

Problem:

One drawback of the bank channel is that Cardlytics can only see which retailer the customer purchased at, not the specific products bought. This limits Cardlytics to half of advertiser spend.

Solution:

Cardlytics acquired Bridg in May 2021 for $350M in cash and two earn-out payments worth over $100M combined. Bridg uses retailers’ point-of-sale data, applies machine learning, and creates individual, anonymous profiles of each consumer’s purchase history with the store. Previously, brick-and-mortar retailers had no insight into their consumers aside from loyalty programs. However, even Starbucks was only able to acquire 20% of its consumers after a decade and most loyalty programs only encompass up to 10% of their consumers. Bridg uses probabilistic matching to compare retailer data with an existing database of over 200M Americans through the Bridg Bureau. POS data is either collected by the retailers’ teams and sent weekly or in real-time via API.

Bridg takes the data it receives from retailers and matches it against the consumer profiles it has through Bridg Bureau, including emails, ZIP codes, and phone numbers. For example, Starbucks could give Bridg the last four digits of credit card, the SKU data, the store location, the ZIP code, and the first and last name and Bridg could match it against a similar profile in their database, and with 60-80% accuracy, identify the consumer making the purchase and log it against their past purchases, as well as add other data like their email address and phone number if they have it. Now, Bridg can take that data and use it to target offers with Cardlytics, assuming Starbucks in this example is a client of both. Bridg has a 9–10-month sales cycle but lacked the scale, with only 13 clients and $12.5M in ARR at the time of the acquisition. However, it shows immense potential when paired with Cardlytics’ existing advertiser base, and they signed a $25M two-year joint deal in Q2’22. Bridg ARR had grown 74% YoY to $21M as of Q2’22.

Competition:

Cardlytics’ competition falls into 3 categories. Those that connect directly with banks, direct-to-consumer card-linked offer sites, and in-house bank programs.

Bank Channel

I believe Figg is the only competitor that integrates directly with banks. Unlike Cardlytics, Figg does not have many proprietary advertiser relationships, as they have gotten their local offers by partnering with Entertainment (acquired by Cardlytics in Q1’22) and the Rewards Network and SKU-level offers from Quotient in the past. These offer aggregators are used by multiple providers and the offers are generally of lower quality and not targeted. Figg does claim to have some national advertisers though. Figg can also facilitate cash back for publishers like Yelp where they get credit card data from Yelp users that want offers and merchants can target Yelp users via their banks. It is unclear if Figg gets direct access to banks’ transaction data, with conflicting statements from different experts but Lynne said at the January 2022 Needham conference that they believe Cardlytics is the only provider with access.

Figg claims they have 100M cardholders, though their actual MAU count is likely substantially lower (<50M) as the average American has 3.84 credit cards! They also claim access to $500B of transaction volume, which is 14% of Cardlytics. The primary difference is that with Figg the cash-back is automatically applied if you shop at one of their merchants whereas at Cardlytics you have to pre-click on the offer wall. Figg measures incrementality through control groups as well but I believe it is likely that ROAS are inflated due to users not having to activate offers. Figg charges only if the user redeems the offer, which Cardlytics also offers as an option. There was a large Cardlytics agency partner that noted higher ROAS with Figg recently and is spending 70% of what it spends on Cardlytics on that channel. I believe this is a fringe case given Figg’s lack of scale compared to Cardlytics.

Direct-to-Consumer Apps

The second type of competitor are DTC card-linked sites like Ibotta, Drop, Rakuten, and Dosh (acquired by Cardlytics in March 2021). Consumers sign up directly for these sites and link their cards in exchange for cash-back rewards. Some of these sites can be quite popular despite their smaller scale and lower level of discount (5-10%). However, users must make the purchase on the app or website so it is not seamless and generally caters to coupon-clippers that would have made the purchase regardless.

Rakuten Rewards, the largest DTC competitor, recorded $11.4B of gross merchandise sales (GMS) in 2021 but just $56.2M of operating income. Rakuten Rewards earned $172M of revenue in Q2’22, 6% of their GMS of $2.68B, implying that they earned $684M of revenue in 2021 with 8% operating margins. Ibotta is estimated to have had $182M in revenue 2020. Cardlytics had disclosed that Dosh and Bridg were 9% of Q3’21 revenue, or $5.85M, minus $2.9M from Bridg, equals $2.95M from Dosh or a $12M run rate.

Although the $275M Cardlytics acquired Dosh for may seem like an egregious price at first glance, it was mainly a defensive acquisition. Cardlytics had fallen behind Dosh with respect to aggregating the neobanks and Dosh had a more modern tech stack. Dosh was also potentially in talks with a large traditional bank at the time. Finally, Dosh provides a testing ground for Cardlytics to A/B test UI/UX improvements given changes to bank interfaces take a long time to approve and had better local offers through the Rewards Network.

In-House Bank Programs

The last type of competitor are in-house bank programs. The largest two are Capital One and Amex though Citi also runs their own program. Amex is not able to share transaction data with outside parties because they follow card issuer rules so they didn’t have a choice, and Citi previously started implementation with Cardlytics but didn’t want to put in the work so Cardlytics rejected them. Capital One and Citi’s offer walls currently use third-party affiliate networks like the Rewards Network. The drawback is that because they don't have access to bank transaction data, the offers are not targeted, meaning lower ROAS from advertisers, meaning smaller offers and fewer advertisers.

Even if Capital One were to try and target offers based on purchase data, they wouldn't have the scale as a smaller platform with less reach is almost always going to have fewer advertisers. Austin Swanson, who has covered Cardlytics extensively on his Substack, recently discovered that Amex recently is running an offer giving users access to Entertainment, a local offers provider that Cardlytics acquired in Q1’22, which potentially opens the door to adoption in the future. Cardlytics recently released a bank self-service platform that allows banks to not directly share data with Cardlytics and instead do it via APIs, allowing Amex to circumvent their card issuer rules. Some existing bank partners like Chase also have their own in-house cashback rewards programs such as Shop through Chase, which is similar to DTC companies in the sense that you have to purchase products through the web portal to earn cashback. This is different from Chase Offers, which is powered by Cardlytics.

Mobile wallets like Apple Pay or Google Pay could be another competitor, but they are limited by their smaller user counts. Apple Pay had 43.9M users in the US in 2021 and Google Pay had 25M. The average annual spend per user was also just $2,439, so they are only seeing a fraction of the transactions that Cardlytics sees.

Opportunity:

The average American spends ~$12.7k on food, entertainment, apparel, and personal care products per year. Assuming 20% of Cardlytics’ user base is engaged and spends $20 per week through the platform, that translates to ~$200 of average spend per user per year ($20*52*20%). On average, $1 of ad spend drives $5 of spend to the advertiser. Assuming the advertiser is realizing 5x ROAS, that translates into ~$40 of billings per user per year ($200/5). $40 of billings per user on 180M MAUs translates into $7.2B in billings and ~$4.8B in revenue for Cardlytics. The US digital advertising market is expected to be $240B in 2022, 35% of which will be spent on ad platforms outside of Amazon, Google, and Facebook, or $84B. Given Cardlytics is able to deliver better and more measurable ROAS than these other platforms, there is ample opportunity for Cardlytics to grow revenue at a 30% CAGR for many years from the $267M they earned in 2021.

As a sanity check, Nimble Opinions on Twitter had the insightful observation that we can estimate the billings opportunity for Cardlytics by calculating billings per user for DTC cash back apps. The average Ibotta user saves $10-20 month, and the average DTC discount rates are ~5-10%; if we take $10 and 10%, that translates to $10/10% = $100* 12 = $1200 spent per year. Take rates can vary from 5-10%, so we can calculate their ROAS is ~10-20x (reciprocal). Since DTC platforms are not able to measure incrementality to nearly the same degree, for conservativeness we can assume they earn 5x ROAS, similar to Cardlytics, which implies $240 in billings per user.

To account for fact that DTCs likely index to bargain hunters, we can assume only 20% of Cardlytics users behave similarly = $48 aggregate billings per user. Note that consumer spend is a function of breadth of merchant offers, and DTC merchant participation is nearly ubiquitous, in contrast to Cardlytics, which has relatively few merchants today. This disparity may be because DTCs charge a rake of 5-10% of consumer spend vs Cardlytics at 20% but Cardlytics spend should be much more incremental, so the merchant value proposition on Cardlytics is just as strong. This exercise is just intended to directionally illustrate the potential magnitude of consumer demand for Cardlytics offers if there are a lot of merchant offers and we see no reason why there can’t be given the superior ROAS and incrementality that Cardlytics is able to deliver as well as the superior user experience (offers automatically applied to card purchases).

Risks:

1. Bank Concentration

The biggest risk to Cardlytics is its bank concentration. As of Q2’22, their top three banking partners, Chase, BofA, and Wells Fargo, formed over 75% of their partner share. Chase and BofA formed >20% each and Wells Fargo formed >10%. Cardlytics stopped disclosing exact splits in Q1’20 but at that point, Chase had already surpassed BofA. Therefore, Chase forms up to 44% of Cardlytics’ revenue today. Furthermore, from Chase's Firm Overview in their recent Investor Day, they disclosed that Chase Offers had ~66M households and 20M consumers engaging with Chase Offers. This also matches CDLX's disclosures of their 30% engagement rate. Note that the 66M figure includes credit cards, so their actual MAU count is likely much lower given the average American owns 3.84 credit cards.

This is why their recent acquisition of Figg, which many investors would consider Cardlytics’ only direct competitor, was such a big deal. However, management reassured investors on their Q2’22 earnings call that Chase had proactively told them they remained focused on continuing their partnership and that Chase simply wanted to focus on SMB offers.

Putting ourselves in Chase’s shoes, there are a few conceivable reasons why they’d decide to do this themselves. Like other banks, Chase primarily cares about engagement, and may not be satisfied with Cardlytics’ slow progress in local and product-level offers. Expert interviews indicate that banks are neutral about the Cardlytics program and some banks like BofA had higher expectations regarding engagement. Also, according to formers, one of the reasons Chase went with Cardlytics was to catch up to Amex which has its own in-house offers program.

Furthermore, Cardlytics’ IR has said that Chase plans on using Figg to enhance its targeting. In the past, banks have been hesitant about providing Cardlytics with PII, but Chase potentially could have acquired Figg and plan to augment their offers with PII to improve ROAS for advertisers, thus attracting more advertisers and improving engagement. However, according to a former employee, Chase has tried to do this in the past with another acquisition and though it is technically possible as the data doesn’t have to leave the banks’ four walls, it’s just really hard to do because you have to clean and refine the data and it skirts the edges with regards to regulation. Regardless, Cardlytics recently built a bank self-service tool with their new ad server that will allow the bank to securely share more data.

With their 66M households, Chase is likely one of the only banks that have enough scale to attract advertisers on their own. Chase would be expanding their Offers program significantly with this acquisition. I was only able to find ~12 employees for Chase Offers on LinkedIn, but Figg has over 70. By taking on such a significant investment, Chase is clearly planning some big moves. Chase was said to have been working with Figg prior to the acquisition, so they must have at least been somewhat satisfied.

However, there are also very good reasons why this acquisition could mean nothing and might even improve Cardlytics’ long-term value:

Chase was working on their own in-house version since 2012 before giving up as they could not get the advertiser relationships due to channel conflict (merchants were asking for interchange fee discounts) and the lack of an advertiser-focused platform. The fact that Chase worked on this for many years prior to signing with Cardlytics in 2018 means they probably understand the difficulty of doing this

Chase also previously acquired a local card-linked offers platform called Bloomspot in 2012 which they shuttered just a year after due to the massive salesforce required to source local offers and difficulties in integration. Bloomspot had 250 employees compared to Figg’s 70 and the internal Chase team was also 100 employees

Cardlytics still expects 50% of MAUs to be on the new ad server by EOY. Cardlytics has previously said that Chase is the easiest path to achieving this goal. This, along with recent expert interviews, lead me to believe that Chase still plans on taking on the new ad server. This raises the chance that Figg is supplementary, at least for the time being, and raises switching costs along with giving Cardlytics a chance to address Chase's pain points of not having local and SKU-level offers

Chase had proactively informed Cardlytics of the acquisition, according to IR. Cardlytics has historically disliked revealing specific details surrounding certain bank contracts, so it is understandable why they did not release an official PR

If we assume Chase accounted for 44% of Cardlytics’ partner share in 2021, they would have made over $62M of free margin. Though this is a drop in the bucket for Chase, it adds to the cost of bringing it in-house amid an already tough macro environment and their recent announcement to preserve capital and stop buybacks

Cardlytics switching costs are also quite high given it takes a year and significant manpower on both sides to implement. A former bank executive estimated that it would take 18 to 24 months to replace Cardlytics, and a few million in software development costs. After it is installed, there are virtually no significant costs on the banks’ side to maintain it

Figg may have tried to sell themselves in the past, and this acquisition may be necessitated by them running out of money. No one at Figg or Chase has posted about the acquisition on LinkedIn

On the positive side, Chase’s acquisition removes Cardlytics’ largest and only direct competitor. According to formers, Wells Fargo and BofA were also using Figg at the time and will now surely leave. BofA recently extended their contract with Cardlytics and will now have more reason than ever to partner closely with Cardlytics to match Chase’s offering. Even if these other banks were looking to do this themselves, without the ability to acquire an existing player like Figg, it would take years to hire a team and build the necessary tech stack and advertiser relationships. There also does not have to be a 1:1 relationship between Cardlytics’ revenue and Chase partner share if Cardlytics is able to successfully divert that advertiser spend to the remaining channels while maintaining the same high ROAS.

While it is possible that revenue from Chase decreases in the near-term as Chase increasingly replaces Cardlytics offers with targeted ones from Figg, and potentially builds their capabilities to the point where they decide to leave Cardlytics altogether given they can leave with 90 days notice, I believe this is unlikely at least until their contract expires in 2025 due to the aforementioned factors. This will give Cardlytics an opportunity to demonstrate higher engagement than Chase can generate themselves as the new UI/UX of the ad server and product-level offers come into effect.

Even if Chase makes the decision to leave for whatever reason, I believe it is unlikely that they will succeed. Figg and Chase have already been at this themselves for years with minimal traction, and the cultural differences will be significant. However, if Chase were to start seeing some success, it would be a potential thesis-breaker.

2. Open Banking

Open Banking is the idea that consumers can share their financial data with third parties through APIs. This is both an opportunity and a threat for Cardlytics. It is an opportunity because it allows Cardlytics to capture consumers outside of banking channels by partnering with retailers like Sainsbury’s in the UK through their Nectar Connect loyalty program. However, it also poses a significant threat in the sense that competing card-linked offers companies can get consumers to give them their bank data using Plaid.

There are a few reasons why I believe these DTC apps like Rakuten, Drop, and Dosh (acquired by Cardlytics) won’t be a significant competitive threat. Firstly, the data feed they receive from the banks is generally less comprehensive, leading to worse targeting and lower ROAS and attribution. Whereas Cardlytics has access to stuff like merchant IDs and defined addresses. Banks are also dragging their feet so they can maintain the consumer relationship but it’s possible to see a future where open banking regulations force banks to provide more granular data and we’re seeing signs of this in Europe. Secondly, the consumers that generally sign up for these apps are coupon-clippers and less loyal, making them uneconomical to acquire. On Cardlytics, advertisers have the opportunity to target users that would have never used a coupon in the first place. Lastly, though Plaid integrates with 11,000 banks and 200M consumers have connected their data, they are not able to use the data to build an advertising platform themselves without competing with their customers.

3. Management Transition

Lynne and Scott founded Cardlytics in 2008. Although they’ve successfully consolidated the card-linked offers industry by partnering with the majority of the major banks in the US, they have demonstrated less success in scaling an ad-tech platform. Scott stepped down as CEO in February 2020 and passed the reigns to Lynne, who made the acquisitions of Bridg and Dosh in 2021. Although their prices were optically steep, I believe both acquisitions made strategic sense. Lynne herself owns just under 1% of the company’s outstanding shares and has been a consistent seller of stock since IPO. Her compensation package was $6.6M in 2021. Glassdoor reviews and some former employee interviews note a frequent shifting of priorities and siloed departments that sometimes work against each other. Despite these shortcomings, it should be noted that Lynne and Scott identified a great opportunity and have succeeded where many others have failed. Notably, Ernie Garcia, co-founder and CEO of Carvana, tried and failed to build a similar card-linked offers company called Looterang prior to Carvana.

Lynne recently announced that she was stepping down effective September 2022 and would be remaining on the board. Her replacement as CEO will be Karim Temsamani, an ex-Google and Stripe executive who started the mobile advertising business for Google, which grew from $0 to a $10B revenue run rate in 2.5 years. He was later the head of Google’s Asia Pacific operations, determining the strategy for 16 offices and products like AdWords, Google Maps, and YouTube. During his time at Stripe, he was led product and engineering for its Payments Products. His experience in scaling advertising platforms as well as working with banks and fintech platforms seems like a perfect fit to scale Cardlytics in its next stage of growth.

4. Groupon

It’s inevitable that coupon platforms like Cardlytics will result in comparisons to Groupon. Although Groupon and Cardlytics share some traits like the two-sided network effects between advertisers and consumers, there are several notable differences. Let’s examine the three reasons I believe Groupon failed:

a. The consumers that used Groupon were mostly bargain hunters that would take advantage of deals to get the services they want but have no loyalty to any single merchant. This was exacerbated by Groupon advertising the same deal from multiple merchants to the same customer.

b. Groupon would charge the merchant 50% of revenues while collecting the full payment upfront from the customer, then only pay the merchant the first 33% in five days and the rest by the end of 55 days. So, if the merchants put out a 50% off coupon on a $100 item, they would only collect $25 and not for a while, making merchants lose money per transaction.

c. There was no real defensibility, consumers would download many different apps to get all the deals. Sure, there were network effects with Groupon having the most consumers and thus being attractive to the most merchants, but because competitors might charge a 25% take-rate instead of a 50% take-rate, competitors will always have some merchants. And since Groupon could never have all the deals, consumers would be incentivized to look elsewhere.

If we think about whether or not these points are relevant to Cardlytics:

a. Unlike Groupon, consumers do not make the conscious decision to download an app, so there are more organic impressions. Cardlytics can also be significantly more granular in terms of targeting users based on their shopping habits, allowing merchants to steal customers from competitors.

b. Merchants can obtain direct insight into the effectiveness of their ad campaigns due to transaction data and control groups that Groupon could never offer. Cardlytics is thus able to guarantee $5 of incremental spend per dollar spent in its channel.

c. Cardlytics' bank relationships ensure that it is the only way for consumers to acquire these offers. Banks care more about engagement than revenue share, so the incremental benefits of DIY pale in comparison to the better offers that Cardlytics can bring via its advertiser network as a function of its bank network and R&D so far.

5. Attribution

It is possible that at some point, merchants will have acquired all the high-value customers that they can get on their loyalty program through Cardlytics already. The people who they haven't acquired that are still utilizing the cashback offer are highly price sensitive and will churn when another advertiser offers them a bigger discount, so the incentive to keep advertising to them is low. Bears would argue that merchants will have no incentive to stay on the platform because they would just be giving up margin at that point, and they'll leave just like they did for Groupon.

I believe it is rational to expect some compression of ROAS over time, as with any ad platform, but just because Cardlytics has acquired a loyal user for a merchant doesn’t mean they should be stopped served coupons. For example, if a Starbucks consumer would go to Starbucks for coffee every weekday, and a McDonald’s across the street for a breakfast sandwich, Starbucks could offer a deal on breakfast sandwiches and win more wallet share. Likewise, McDonald’s could offer a deal to another set of consumers on coffee. Without Cardlytics, Starbucks would not be able to know how much its customers are spending at competitors and it would be easier to win more wallet share with them than acquiring a net new customer. Furthermore, businesses like hotels or movie theatres with high fixed costs could leverage Cardlytics to fill rooms or seats during non-peak times. This would happen until ROAS compressed to the point where it’d be no longer attractive relative to other channels. Cardlytics is also so sub-scale right now both in terms of user engagement and advertisers that it'll be a long time before this becomes an issue.

6. Boosting Offers

Amex notably passes back all of its partner share, resulting in higher value offers. Chase and other banks might be attracted to this model and potentially seek to cut out Cardlytics’ partner share and use it to boost in-house offers, thus boosting engagement and attracting more advertisers.

However, though Chase is already boosting some Cardlytics offers today, it is also still collecting revenue share. One would think that banks would be passing back all of their existing partner share first before seeking to use Cardlytics’. Moreover, maximizing value is not necessarily achieved by offering the largest discount, but by offering the minimum discount that will still get the consumer to purchase the item which will result in higher ROAS for the advertiser. This level of discount is different for each consumer.

Cardlytics is better positioned to find that point than Amex or Capital One due to their ability to target offers to consumers based on transaction data. Cardlytics also has a much wider view of transactions as a function of their larger userbase which should enable better targeting as well as a wider base of potential advertisers and offers to choose from.

Valuation:

Cardlytics records the gross amount charged to advertisers as billings. One-third of billings is set aside to be used as consumer incentives, funding the cash back rewards. Of the remaining two-thirds, ~56% is given to Cardlytics’ bank partners as partner share, and around another 6% is used to deliver the offers, resulting in gross margins of ~38%. Cardlytics offers two pricing models: Cost per Served Sale (CPS) in which Cardlytics sets the level of discount (consumer incentive) and charges advertisers for each consumer that is served an ad and subsequently makes a purchase at the advertiser regardless of whether or not they activate the offer, and Cost per Redemption (CPR) in which advertisers set the consumer incentive and are charged only if consumers activate an offer. CPS is more popular as it allows Cardlytics to have a more targeted approach in determining the appropriate level of discount and accounted for 64% of revenue in the trailing 6 months.

Although Cardlytics no longer reports the exact MAU and FI share of each bank, they did so until FY’18, allowing us to calculate BofA ARPU. During 2016, 2017, and 2018 Bank of America contributed 47%, 51%, and 47% of Cardlytics’ average FI MAUs, respectively. During 2016, 2017, 2018, Bank of America accounted for 64%, 63%, and 64% of their total FI Share, respectively.

Assuming BofA shared the same FI split as the rest of the banks (likely it is even higher since BofA was Cardlytics’ first bank partner and is said to have the best economics as a result) then revenue from BofA would be $72M, $82M, $96M in 2016, 2017, and 2018 respectively. BofA MAUs would be 20.6M, 28M, and 30.5M respectively. APRU would therefore be $3.50, $2.92, and $3.15 respectively, compared to $2.23, $2.23, and $2.30 overall. Clearly, BofA was especially well-optimized as an early partner for Cardlytics, with the best user interface and highest engagement, leading to the highest ARPU.

ARPU dipped from $2.30 at the end of 2018 to $1.51 in 2021 as Cardlytics added Chase and Wells Fargo and greatly expanded their MAU count. However, I believe it is reasonable to expect ARPU to surpass $3 over time as Cardlytics has time to optimize other bank partners in a similar manner as they did at BofA. There is also a strong case to be made for ARPU far exceeding $3, with Lynne targeting over $10 ARPU in the years to come. Since 2018, Cardlytics has improved their user interface with richer imagery, better targeting, product-level offers, grown its advertiser count, expanded into new verticals like DTC, and expanded into higher-priced items like hotels and airline tickets.

At their 2021 Investor Day, Cardlytics expected to return to a $2.30 ARPU within a few quarters. If we assume MAU grows at a 5% CAGR over the next 5 years and at a 2.5% rate thereafter, ARPU grows at a 20% CAGR, EBIT margins expand to 20%, a discount rate of 8%, and a 20x EBIT exit, we are left with a very attractive 25% IRR. However, if we assume that Cardlytics loses Chase and thus its MAUs are reduced by 66M to 114M in 2023, but it is able to continue monetizing other banks and growing MAUs at a similar pace, we are left with a 15% IRR assuming a 15x EBIT exit. Keep in mind, my MAU assumptions are likely conservative, given the 66M figure is credit cards, so it’s possible that half or a third of that figure are actual MAUs.

It should be noted that along with the $350M in cash Cardlytics paid for Bridg, there will be two earn-out payments on the first and second anniversary of the acquisition. The value of these payments can be found on the balance sheet under the current and long-term contingent consideration. The long-term consideration was marked down to zero in Q2 as the fair value of Bridg declined, leaving just the $164M current consideration. Cardlytics expects to pay $43.5M of cash in Q3, as the minimum cash payment required is 30%. This leaves $101.5M of stock required for the payout at a $40 VWAP, or 2.54M shares, but Cardlytics had repurchased $1.4M shares in Q2. So, the remaining dilution will only be 1.14M shares. Furthermore, the new CEO Karim will be granted $20M worth of shares at the 30-day trailing average stock price prior to the hire date (September 1st). 25% of the RSU Award will vest on the first anniversary of the Hire Date, and the remaining 75% of the RSU Award will vest quarterly over the following three years. If we assume the average stock price is $15, that’s ~1.3M more shares. After these dilutive events, total share count would increase by 7% to 36.5M.

I view the potential for a liquidity event if Chase leaves to be low given it is highly unlikely in the near term given their intention to move onto the new ad server and the time it will take to build a competing offering. Cardlytics is targeting to become FCF positive by Q3’23. Cardlytics has operating expenses of ~$120M excluding D&A and SBC, and assuming they have 114M MAUs and ARPU grows 20% to $2.17 in 2023, they will have $248M in revenue, or $94M in gross profits. They’ll burn ~$30M in cash including capex compared to their $157M balance at the end of Q2’22 (will be $113.5M after their first Bridg earn-out payment in Q3), with a $60M untapped loan facility.

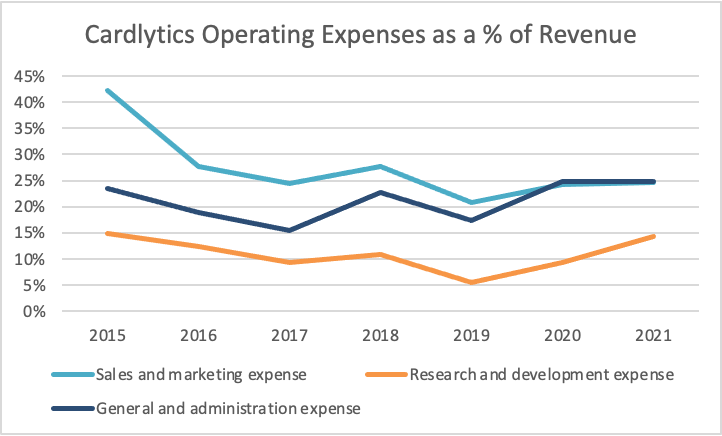

Cardlytics showed improving operating leverage until 2019, though as it ramped up investments in additional products like Bridg and revenue growth declined, its operating margins declined. However, it is also an asset-light company, so it should be relatively easy to adjust operating expenses if necessary. Stock-based compensation also accounted for 19% of revenue in 2021. Cardlytics is already pausing hiring and implementing a plan which is expected to realize $15M of annualized cost savings. Although there is still a need to invest to get the flywheel going, Cardlytics has a differentiated value proposition and a wide moat, so I see the opportunity to realize significant operating leverage in the future.

While it is possible that the loss of Chase creates a vicious cycle from the loss of scale, leading to lower advertiser growth which leads to lower engagement which leads to less ability to reinvest in better features and eventually culminates in other bank partners also leaving, I view this as unlikely. With the exception of Bank of America, no other bank has the scale to attract national advertisers, and without Figg, none of them have the talent and infrastructure to build it themselves. Furthermore, Chase is widely known as one of the most tech-forward banks and likes to in-house stuff, and they tried for nearly 6 years to replicate Cardlytics and failed.

Conclusion:

In RV Capital’s 2021 Letter, Rob Vinall stated the following: “To the extent [businesses] make economic profits, they either have a sufficiently wide moat to offset their operational ineffectiveness, sufficient operational effectiveness to offset the lack of moat, or a combination of the two.” While I acquiesce that I’ve been disappointed with Cardlytics’ slow pace of execution on scaling the ad platform, I believe the benefits derived from all stakeholders, increasing returns to scale, and the high switching costs of the bank channel create a predictable end-state. Consumers will always want to save money on their purchases, banks will always want consumers to spend more, and advertisers will always want the best bang for their buck. Cardlytics still needs to execute as its flywheel has barely started spinning, but I am willing to give management a bit more leeway than usual due to the strength of their moat.

I don’t know what Cardlytics’ revenue will be over the next quarter or the next year, but I do believe the pieces are falling in place for this to become a substantially larger company over the long-term. Cardlytics has already built out its bank channel, they have already proven an ability to reach at least $3.00 ARPU at their best bank partner, consumers have already demonstrated much higher engagement with DTC cashback apps despite worse offers, and Cardlytics has already proven their channel can deliver measurable 5x ROAS at scale. Furthermore, I believe promising early signs from adoption of their new ad server and product-level offers as well as the experienced new CEO create the opportunity for growth to meaningfully accelerate.

I believe the market is overestimating the probability of Chase leaving and underestimating the potential ARPU Cardlytics can earn over time. It is said that the best investment opportunities come at moments of extreme uncertainty, and the combination of macro headwinds, the management transition, and Chase’s acquisition of Figg have pushed Cardlytics stock to multi-year lows. I believe that this creates an opportunity for patient investors that can tolerate short-term volatility in both the stock price and operating results to purchase a unique asset with a significant moat and potential to grow at a 30% CAGR over a long time for a bargain price.

For more on Cardlytics, including frequent updates, I highly encourage you check out Austin Swanson’s Substack. His articles are very in-depth and my discussions with Austin have been very helpful in my research. He also provided helpful feedback on this article.

Cliff Sosin, PM at CAS Investment Partners, also did two very helpful podcasts (here and here) on Cardlytics which got me initially interested in the name. He is a very thoughtful investor and I encourage you to check them out.

I currently own a position in CDLX. My employer does not own shares at the moment. This write-up is for informational purposes only and not intended as investment advice.

Feel free to reach out to me via email.

Great write-up, Richard! I really enjoyed reading this one. Always nice hearing different points of view around the same business and same situations. It will be fun to see what develops with Cardlytics, especially with regard to Chase.

Absolutely loved your content Richard, would you be open to allowing us to share it with our 60k+ audience as well?